Content:

Personal Journey Update

Twitter Thread

Video

Easily Predict Crypto Bull and Bear Markets (4/5)

Top 5 Web3 News Articles this Week

Weekly Fact

Quote of the Week

Creating a 5-Part Newsletter Series

If you’re just joining us, I’m currently writing a 5 part newsletter series. This series covers five topics that I believe you need to master to find success when investing in crypto. This will not be financial advice but my own opinions from my own experience.

This series will help you:

Make crypto a more pleasant and less stressful experience.

Form better mindsets to help you find success.

Highlight long-term and short-term investment strategies.

Save you from losing everything

If this sounds like something that will help, stay tuned as I will also be creating a FREE small crypto guidebook (e-book) that will compile everything from this series. This guidebook aims to hopefully teach you all the do’s and don’ts in crypto to make your investing journey a little easier.

Twitter Thread

Video

Easily Predict Crypto Bull and Bear Markets (4/5)

Understanding the dynamics of crypto markets is becoming increasingly important. Exploring practices that can help you better understand crypto markets will help you make better investment decisions.

Bitcoin's 4-year cycle

If you don’t understand how Bitcoin’s 4-year cycle works, I highly recommend watching the video linked to this newsletter.

Here’s a quick summary anyway:

Every four years miners who validate Bitcoin transactions have their rewards cut in half

This then creates a supply shock as less bitcoin is now being introduced into the market

As demand grows for Bitcoin, simple supply and demand mechanisms play out, making Bitcoin’s price go up.

6 months to a year after the price going up follows a sharp decline as investors start to take profits and hype generated from the halving dies down.

Bitcoin then typically enters a prolonged consolidation period lasting around three years. During this time, the price of Bitcoin steadily increases as we approach the next halving event, which is followed by the cycle repeating all over again.

The Bitcoin halving has been observed since its inception, where its price tends to follow a predictable pattern over four years. Understanding this cycle can help investors make informed decisions about when to buy and sell their Bitcoin holdings.

How to take advantage of this cycle

Buying:

Consider buying Bitcoin during the consolidation period that follows after the sharp decline.

This is because the price tends to be at its lowest during this period, and history has shown that prices tend to rise again during the growth period that follows.

Dollar-cost-averaging during this period will allow you to avoid any more sharp price movements and will generate a healthy low entry point.

Selling:

Most people assume selling before the halving would be most profitable as it sounds like a buy the rumour, sell the news type of situation.

This is not true, just look at what happened during the first two Bitcoin halvings.

The first halving occurred on November 28th 2012 when one BTC was worth around $11. A year later, bitcoins price surged to a mouth-watering $1,100 in 2013, a price never before seen with Bitcoin.

It had only been one year since the halving and Bitcoin had grown 100x.

Bitcoins price eventually fell to around $220 and it remained below $1,000 for the next few years. Even at its bottom Bitcoin was still up 20x from it’s price before the halving.The Second Halving

The second halving took place in July 2016. Bitcoin maintained a price of around $600–$700 before flying to $20,000 in the great bullrun of 2017.

Bitcoin had grown over 33x from it’s price before the second halving and over 1,818x from its price before the first halving.

As you can see Bitcoin’s price is at its highest roughly a year after the halving. This is because actual mechanics are at work, the 4-year cycle isn’t just a way to hype people up. It has a real physical effect on the supply which increases scarcity.

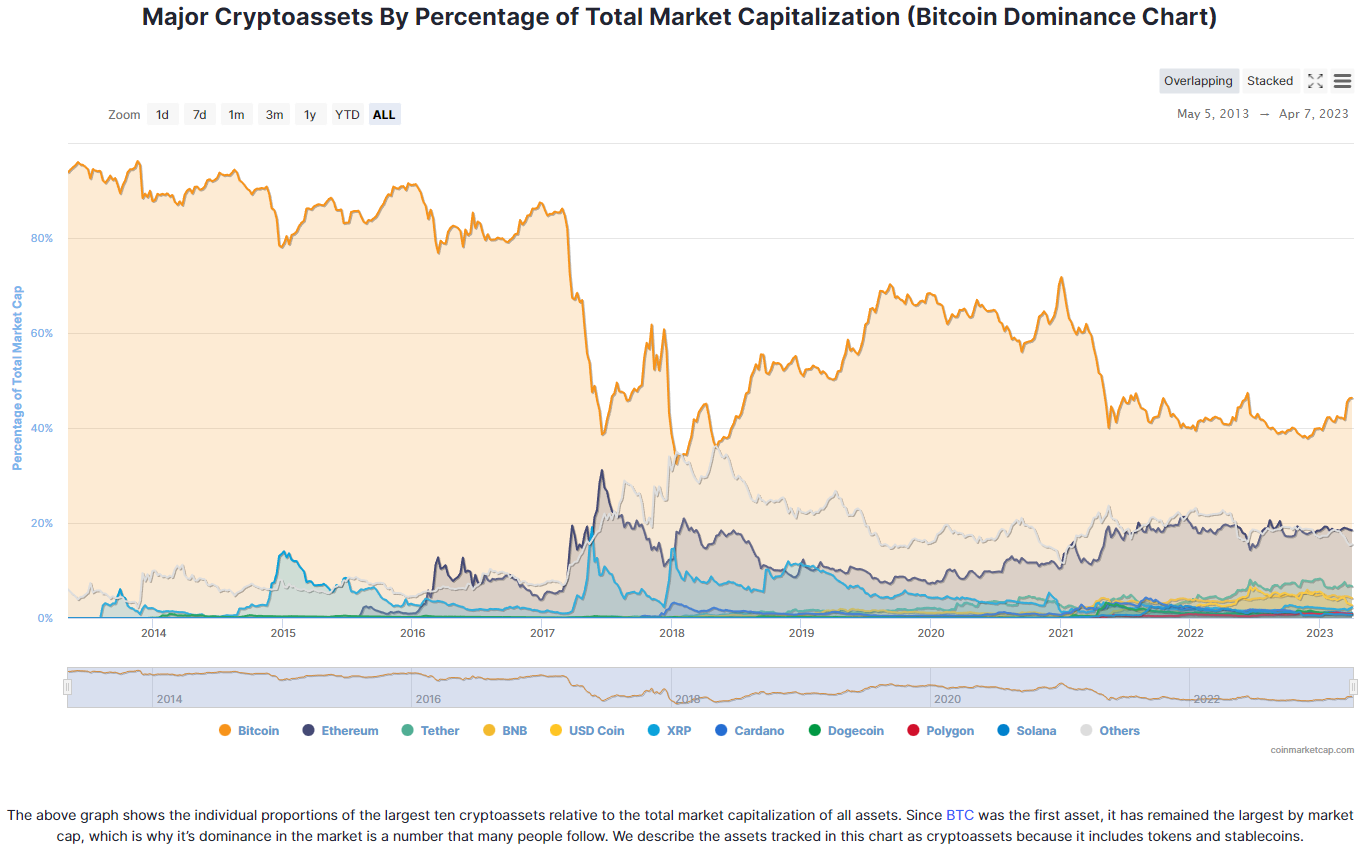

As we start to see more altcoins like Ethereum take more dominance away from Bitcoin. People believe that Bitcoin's 4-year cycle will have a lesser effect on the crypto markets.

This may be true but I don’t believe this to be true yet, as Bitcoin still holds significant dominance over the whole crypto market and it’s obvious the cycle is still the main factor controlling the market long term.

Understanding the Bitcoin halving and how and when it occurs will make you a much better crypto investor. It’s not something that will make you profits in the short term but will significantly increase your chances of making profits in the long term.

Traditional Markets

Traditional financial markets still influence the crypto world. Major events in the financial world, such as economic downturns or government policy changes, can affect the price of cryptocurrencies.

By paying attention to these events, investors can adjust their cryptocurrency holdings accordingly, and use these changes to focus on making short-term gains.

I’m not going to sit here and tell you what indicates a good time to buy and sell, I’ll simply list previous events and how they influenced crypto market prices.

Economic indicators:

Economic indicators, such as GDP, inflation rates, and interest rates, can have a significant impact on the value of fiat currencies, as well as the overall sentiment of investors. This can, in turn, affect the demand for cryptocurrencies.

Increase in rates: lower appetite for riskier investments which creates a significant pullback in digital asset prices.

Decrease in rates: Higher appetite for riskier investments making crypto prices go up.

Stock market performance:

The stock market is often seen as an indicator of overall economic performance, and major events such as stock market crashes or bull runs can have a ripple effect on other asset classes, including cryptocurrencies.

Keep an eye on the Coinbase stock price, it’s usually influenced heavily by the performance of crypto markets, but if it starts to pump without this influence, this could indicate more money flowing into crypto before markets have reacted, which may indicate a crypto buying opportunity.

Government policies:

Government policies related to taxes, regulations, and monetary policy can also impact the crypto markets. For example, if a government announces a crackdown on cryptocurrency exchanges or mining activities, it can lead to fear and decrease crypto demand, lowering prices.

Example A: In Dubai, people are not required to pay tax on their crypto profits, helping further adoption which increases the price of crypto.

Example B: In 2021, China stopped people from mining crypto which affected the price negatively.

Investor sentiment:

Investor sentiment can be influenced by news events, rumours, and speculation. This can lead to sudden changes in the demand for cryptocurrencies, causing prices to fluctuate.

Example: COVID outbreak saw people panic as uncertainty was at the forefront of people's minds, leading them to take less risk which meant a huge sell-off of crypto assets.

Banks going bankrupt

Hurts risky crypto assets but lately has seen Bitcoins price increase due to people using it as a hedge against the US dollar similar to how people treat gold.

I would like to take this chance to inform all readers that I am in no way shape or form a financial advisor and everything stated in this newsletter, previous newsletters and future newsletters is my own personal opinion. Before making any investment decisions make sure to conduct your own research and seek the advice of a professional financial advisor.

In conclusion, understanding the dynamics of how crypto markets are influenced is key to making informed investment decisions. To summarise the key areas that influence crypto markets:

Bitcoin's 4-year cycle

Traditional financial markets

FED interest rate hikes

The growing adoption rate of blockchain technology,

Remember, the cryptocurrency market is constantly evolving, and staying informed is critical to making informed investment decisions. By understanding market fundamentals, analysing market data, and staying up-to-date with the latest news and trends, you can increase your chances of long-term success.

Top 5 Web3 News Articles This Week

Can ETH hit $2,000 before the Shanghai upgrade? This dataset suggests that…

‘BitBoy’ Ben Armstrong Faces Legal Action From FTX Class Action Lawyers

Jim Cramer on Coinbase stock: ‘I wouldn’t touch this thing at all’

Charles Hoskinson: Cardano delays due to betting on wrong tech, ambitious roadmap

Weekly Fact

Comic Sans is the most hated font in the world.

Comic Sans was designed to be an unserious, handwritten style font to use in comic books.

Although everyone loves to hate this tasteless font (including myself!), it is actually very useful for dyslexic people.

Because of its asymmetrical style, the letters are much easier to discern.

Quote of the Week

Let me know any ways you think this newsletter can be improved.

Also, feel free to drop your newsletter links down below, I’m always grateful for more inspiration.